Digital ID Wallets: Differences in Adoption Between the EU & the US

- What Exactly Are Digital ID Wallets?

- Digital ID Wallets and Payments - What’s the Connection?

- Digital ID Model Distinctions in the EU Vs. the US

- Benefits of Digital ID Wallets

- Challenges and Risks of Digital ID Wallet Adoption

- Bottom Line: Is the Digital ID Wallet Initiative Good News?

The idea of integrating secure and trusted digital ID wallets on a national level has been present in the European Union and the US for many years. Thus, as global digitization continues, both of these geographical areas develop their take on the adoption of this initiative.

This guide will take you through the concept of digital ID wallets, explain the distinctions between the US and EU approach to their integration, and list the risks and potential obstacles that can be encountered throughout the implementation process.

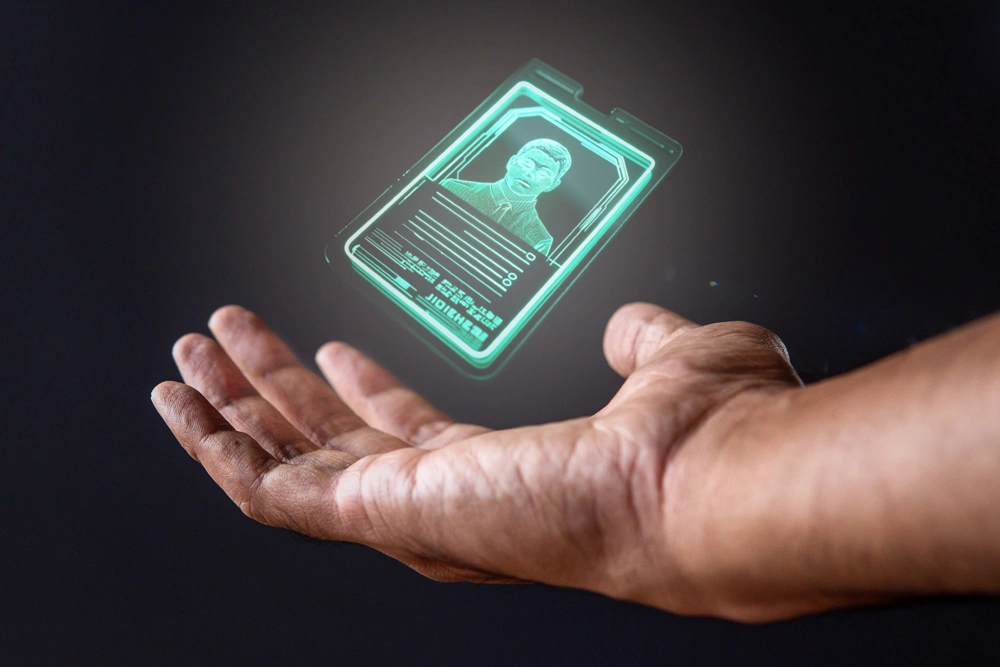

What Exactly Are Digital ID Wallets?

Digital ID wallets are smartphone-based systems designed for securely storing the owner's essential documents and personal information, including:

- Identity cards

- Driving licenses

- Medical records

- Bank cards

- University degree titles

Currently, both centralized and de-centralized digital ID schemes exist across many countries worldwide, featuring their respective pros and cons.

Digital ID Wallets and Payments - What’s the Connection?

Identity and payments are tightly interlinked. This creates exciting opportunities yet makes payment solutions vulnerable to a variety of risks, such as phishing and identity theft.

Thus, while the financial services sector has already proven it can offer uberized experiences, it has yet to conquer a new frontier by developing an advanced and secure digital-first ID wallet experience that can serve users on both national and international levels.

Digital ID wallets that will enable people to verify their identity and make payments throughout such large jurisdictions as the EU and US will need to possess the following features:

- Unmatched consumer data security

- Seamless application

- Straightforward onboarding

- Simple issuance process

- User-friendly design

- The absence of manual intervention required

Besides, when developing such a fundamental online identification and payment system, it’s critical to keep local user preferences and expectations in mind. This is one of the key reasons why the adoption of digital ID wallets in the EU and the US cannot follow identical paths.

Digital ID Model Distinctions in the EU Vs. the US

However, the COVID-19 pandemic prompted the majority of jurisdictions to focus on streamlining the transition to fully digital ID wallets, with the US and EU being among the fastest markets to adapt.

Let’s take a closer look at the main distinctions between the approaches to digital identity adoption in these two regions:

European Union

In contrast, the adoption of branded e-wallets, such as Apple Pay and Google Pay, is a reason for concern among many EU governments, as their citizens’ identities are being aggregated and controlled by foreign-owned organizations.

Thus, a unified digital identity wallet is expected to meet the needs of both governments and their residents and become a much-needed response to the growing demand for convenient online identification and sensitive information storage.

The EU-backed Digital ID Wallet (EDIW) project will officially start with a pilot phase in 2023, with the expectation for every member state to introduce it to its citizens by 2024.

United States

When it comes to the US, most Americans doubt the efficacy of a government-issued national ID wallet, viewing it as an additional control measure of the state.

However, at the same time, many US citizens are willing to use their identity credentials within their Apple Pay or Google Pay digital wallets.

In response to this sentiment, Apple has registered several patents related to verified identity claims and is working on creating a de-centralized ID wallet solution that will control the verification of identity documents like driver licenses and passports via iPhone or Apple Watch.

Benefits of Digital ID Wallets

Despite the varying approaches to digital ID wallet adoption in different countries, the potential advantages such identification solutions offer are universal, namely:

- Secure storage of sensitive information

- Safer identification and payment processes

- Improved control over data sharing

- Outstanding convenience for users

- Simplified transactions

- A unified and transparent system available across different jurisdictions

- The absence of need to carry printed documents

However, even though digital ID wallets are sure to promote inclusion and economic opportunity across countries, their integration is far from being challenge-free.

Challenges and Risks of Digital ID Wallet Adoption

The main risks both centralized and de-centralized digital ID frameworks may be facing are biometric and synthetic identity fraud. In the first case, dishonest players aim to compromise the unique genetic code of an individual, while the latter type of fraudulent activity entails bad actors creating a fake identity by combining the credentials of multiple different people.

This is especially true for industries such as healthcare and financial services, where sensitive details need to be kept for extended periods, such as 10 years or longer. Thus, to protect critical data from leaking, organizations in these niches will need to adopt advanced security measures, such as behavioral biometrics, adaptive risk-based authentication, and device reputation checks.

As for digital ID wallet implementation challenges, the key aspects that need to be tackled are:

- The competition of interests between governments and tech giants

- The absence of unified implementation standards

- The lack of interoperability across platforms in different countries

As digital wallet projects advance across different jurisdictions, governments and organizations may see other risks and challenges arise. That’s why remaining alert and agile is key to a successful adoption process.

Bottom Line: Is the Digital ID Wallet Initiative Good News?

Therefore, although every region is adopting digital ID frameworks at its own pace, with a unique approach, and facing distinct challenges, the ultimate goal of introducing mobile ID wallets is to optimize day-to-day identification operations and ensure their convenience, security, and inclusivity, making this initiative a critical step toward a digitalized world.

1 - McKinsey - How governments can deliver on the promise of digital ID

2 - Thales - Thales Major Citizen Survey Predicts Warm Welcome For New European Digital ID Wallet

Thank you for reaching us. Your request has been sent successfully. We will get back to you as soon as possible.

Message was not sent