End-to-End Data and Privacy Protection in 2022 and Onwards

The protection of consumer data and privacy is considered to be one of the top three trends with the greatest impact on businesses in 2022. However, the focus on these critical aspects is sure to last beyond the end of this year.

Read ahead to understand what is the state-of-the-art and holistic solution to data and privacy protection for businesses.

Why Data Protection Requires a Holistic Approach

In the digital-first economy, ensuring data protection becomes a multifaceted process that involves a variety of aspects, including:

- Data privacy

- Fraud reduction

- Compliance with regulations

- Up-to-date tech solutions

As the global situation changes, so do the regulations in force. At the same time, new technologies emerge alongside advanced fraud methods. These factors become amplified by the fact that payments are no longer limited to traditional channels, and it’s not so obvious who is in charge of customer data protection anymore.

In this ever-evolving ecosystem, businesses have to constantly stay alert to notice such shifts and adjust their approach to data protection.

Dealing with Local and Global Regulations

Both small and large-scale businesses are facing the need to navigate the emerging guidelines and regulations on local and global levels, such as the GDPR, CCPA, LGPD, and PCI DSS, to name a few. The wider the business’s operations expand, the more stratification of regulations it is likely to encounter across jurisdictions.

However, while compliance with multiple laws can be complex, it’s absolutely necessary to provide the recommended level of data protection to the consumers and avoid the charges associated with the evasion of these responsibilities.

Latest Tech: Your Reliable Partner in Ensuring Data Privacy

Payment providers are leveraging FinTech solutions to address modern-day data security issues. For instance, one of the latest ways of ensuring the protection of sensitive data is tokenization.

This security method is used to separate personally identifiable information (PII) from other consumer data. This way, a business can have the best of all worlds: provide a decent level of user protection, use non-personal information for business insights, and remain compliant with the current regulations.

The Key to Advanced Data Privacy

As you can see, the provision of data privacy is a complex and, at times, confusing process due to the amount of contradictory information available. However, there’s a solution that suits virtually any business - finding a payments partner that specializes in data protection.

Outsourcing professional services enables you to take care of other vital business needs while having peace of mind regarding your clients’ data privacy. While this approach doesn’t alleviate the responsibility for compliance with the regulations off your shoulders, it simplifies the way you will achieve meeting all the necessary requirements.

How Can Payneteasy Help Your Business with Data Protection?

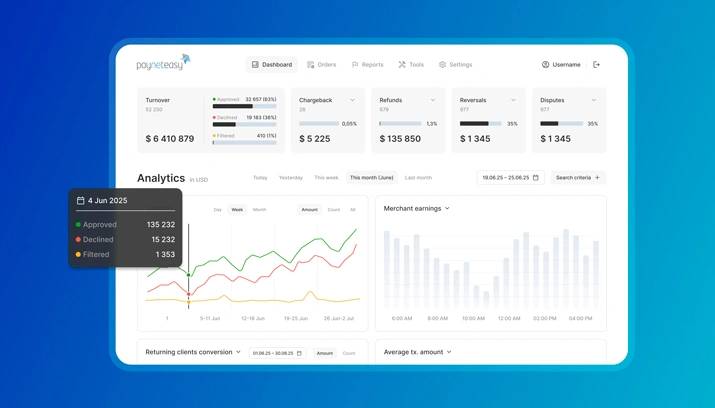

Payneteasy is a payment platform provider trusted by banks, PSPs, financial institutions, and businesses worldwide. Our goal is to empower you with strong technology so that you can achieve your top level of performance.

Our solutions are tailored to the needs of your business and blend frictionless payments, straightforward back office, and advanced data protection together. Our clients also enjoy smart traffic routing, fast software integration, and 24/7 tech support. Contact us now to get started with data protection or any other payment project as soon as possible!

Thank you for reaching us. Your request has been sent successfully. We will get back to you as soon as possible.

Message was not sent