From Gateways to Orchestration: How Payments Became Smarter

Commerce today moves quickly and rarely stops at national borders. Payments, however, haven’t caught up to that simplicity. Each region comes with its own set of rules, acquirers, and technical standards, which makes maintaining multiple integrations an ongoing and often demanding process.

Declined transactions only add to the strain. They can result from technical faults or overly aggressive fraud checks, and each decline carries real costs in lost sales, higher operational effort, and customer frustration. For high-risk merchants, those challenges multiply under tighter scrutiny and steeper fees.

That’s why many companies are shifting toward a blended model built on a payment orchestration platform that connects the reach of gateways with the intelligence and adaptability of orchestration.

Introduction to Modern Payments Stack

Payments have always involved many moving parts. Gateways took care of moving money, orchestration managed the paths transactions could follow, and merchants had to connect and maintain each piece themselves. That separation worked, but it often led to slower setups, higher costs, and less flexibility when markets or rules changed.

Today, those roles have come together into a single system. Modern providers combine gateway functions with orchestration logic, giving merchants a single place to manage transactions, data, and compliance. Let’s take a step back and see how it all came about.

Early Model and Fragmented Infrastructure

In the early days of online payments, merchants faced a fragmented system. Each new payment method or provider required a separate integration, and features such as fraud checks and reporting had to be added manually. Some businesses added extra tools to manage multiple gateways or retry failed transactions, but these components often operated independently, leaving setups complex and prone to inefficiencies.

The first model relied on a single payment gateway, and the second added an orchestration layer.

Payment gateway

In the early stages, a payment gateway focused on encryption, data transfer, basic payment methods, and simple integration. It captured transaction data, secured card details, sent them to the acquiring bank, routed payments through networks like Visa or Mastercard, and returned an authorisation or decline. Gateways also offered features such as recurring billing, subscription management, and basic fraud checks.

The integration process typically required a single API or plugin, which made gateways a practical and straightforward solution for many merchants.

Payment orchestration

Orchestration was developed to address the increasing complexity that single gateways couldn’t handle. Its main function was to connect a merchant to multiple gateways and alternative payment methods at once. Beyond simply linking systems, orchestration managed routing, retries, and fallback options to improve the chances of successful transactions. When a payment failed through one route, orchestration automatically tried another without interrupting the customer.

It also provided additional monitoring and reporting, which helped businesses understand which paths were most effective and adjust their processes over time.

Although orchestration required more setup than a single gateway, it allowed merchants to centralise control, reduce reliance on any one provider, and handle a wider range of payment types and regions efficiently.

Today’s Model and Unified Approach

The newer, unified system doesn’t replace either model. It draws on the best aspects of each and unites them into a single framework. The foundation remains much like the early setup, but the focus shifts to which elements a business relies on most and how they fit together to handle modern payment demands.

Enhanced gateways

Modern payment gateways reach far beyond simple transaction processing. They handle encryption, data transfer, and authorisation while supporting dozens or even hundreds of payment methods, including major credit and debit cards, digital wallets, and local options. Many include built-in routing logic, retries for failed transactions, and anti-fraud features that once required separate systems.

Some providers focus on specific segments and support a range of card types and popular wallets, such as Apple Pay and Google Pay, without complex payment routing or fallback systems. The setup works well for businesses with a smaller geographic footprint or straightforward payment needs. Merchants can keep operations simple and avoid adding multiple layers of infrastructure.

Integrated orchestration

Orchestration systems, once separate from gateways, now often include their own processing while continuing to manage multiple gateways, route transactions, and coordinate alternative payment methods across regions and currencies. They provide fallback options and monitoring that improve success rates and give businesses insight into declines and approvals.

This combination creates a unified payments stack. Businesses benefit from the reliability and simplicity of enhanced gateways, together with the flexibility and control of orchestration. The result is a system capable of handling high volumes, cross-border payments, and a variety of transaction types through a single interface.

Interestingly, the way these approaches come together varies depending on the business and its priorities. The key is that both models coexist. The choice of which elements to emphasise depends on transaction volume, geographic reach, payment methods, and risk management.

What Does This Mean for Business?

The real test of a payment setup is how well it supports the business behind it. A strong orchestration model keeps payments steady, efficient, and secure even when volumes rise.

1. Banking-grade reliability

Modern payment platforms now reach the level of reliability once found only in major banks. They rely on a fault-tolerant setup that keeps payments active even if one provider fails. What matters isn’t the uptime figure but the ability of the system to stay steady.

Payneteasy applies this principle through a multi-provider structure that maintains uninterrupted transaction flow even under heavy load. This kind of stability directly supports business results. Payments go through even at peak times, customers feel confident, and revenue stays protected when the pressure is highest.

2. High acceptance rates: smart traffic & cascading

Integrated payment stacks use smart routing to send each transaction through the path most likely to succeed. If one route fails, the system automatically directs the payment through another acquirer in a multi-acquirer setup until it goes through. This process, known as cascading, happens in real time and keeps approval rates consistently high.

For a business, that means a higher payment success rate with the same traffic. Each successful payment adds to revenue, and customers complete their purchases without delays or errors.

3. Real-time chat support

Response speed is not just a measure of service quality but a foundation for business stability. That’s why leading PSPs aim to offer real-time support through chat, instant messaging, and dedicated account managers. In reality, support standards differ. Some providers may take weeks to resolve technical or integration issues.

Payneteasy focuses on real-time communication and personal assistance: every client knows their direct contact and can rely on fast help for integration and transaction review. The approach helps isolate issues quickly and keeps processes under control, so the client’s team can focus on business growth instead of technical problems.

4. Fast integration

Orchestrated payment platforms make setup fast and simple, often completed within one to three weeks. Ready SDKs, clear APIs, and technical support at every step help teams connect payment systems without long development cycles or heavy engineering work.

This pace allows new products to launch quickly and adapt to market needs without delay. Companies can reduce costs and start processing payments far sooner than before.

5. Advanced security & anti-fraud

Blended payment infrastructure applies several layers of protection, from tokenisation and 3DS 2.2 to constant monitoring for unusual patterns. Security runs through every part of the process as each transaction, route, and user action is checked against potential risks.

Such depth of control keeps fraud low and compliance strong. Chargebacks become rarer, regulations continue to be met, and customers feel safer when they pay.

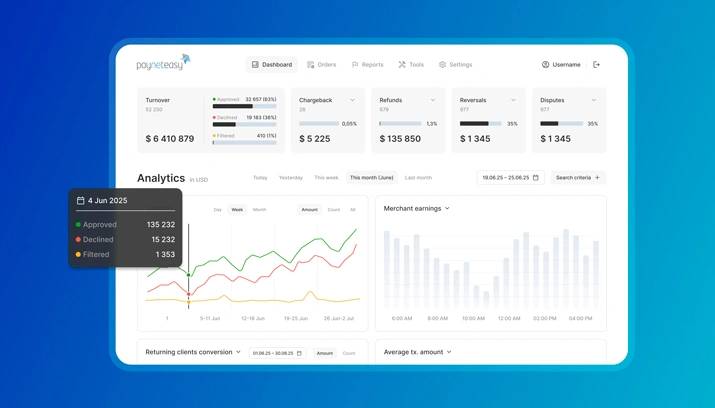

6. Robust reporting & financial tools

Modern payment platforms include detailed analytics and financial tools that show every step of the payment flow in one place. Real-time dashboards, reconciliation reports, and downloadable data give a clear picture of performance and costs.

Payneteasy’s reporting suite unites technical precision with usability and gives merchants instant insight into transaction trends and operational metrics. With all information gathered in a single overview, decisions become faster and more accurate. Teams gain control over their payment process and find new ways to reduce expenses.

Practical Impact of Merging Gateways and Orchestration

The merging of gateways and orchestration has turned payment systems into full-service ecosystems that handle reliability, routing, and risk in one place. Merchants see stronger approval rates and tighter protection while simplifying how they connect and maintain their payment tools.

The outcome is steady performance, lower costs, and a payment process that feels consistent for both sides.

FAQ

If we already have a payment gateway, why would we need orchestration?

A single gateway works well for straightforward setups, but as payment volumes grow or new markets open, orchestration helps manage different routes, currencies, and methods in one place. It gives you more flexibility without forcing you to rebuild everything from scratch.

Is it possible to work with just one provider without losing efficiency?

Yes, many businesses do. The key is to notice when your current setup starts holding you back. As you grow and reach new regions or handle more payments, orchestration helps your system keep up and stay reliable.

Does orchestration replace gateways?

Not exactly. Orchestration builds on gateways rather than replacing them. It connects several gateways or acquirers under a single structure so payments can flow through the most efficient route.

How complex is the integration process?

Modern providers have simplified the process with ready-made APIs and SDKs. Integration now takes a few weeks instead of months, and technical teams need less hands-on work.

Can orchestration reduce transaction costs?

It can, by routing payments to the most cost-effective provider and improving acceptance rates. Over time, this leads to better margins and fewer failed transactions.

How do I know if it’s time to move beyond a single gateway?

When you start growing into new regions, adding more payment options, or noticing higher decline rates, it might be time to look at a more blended setup. Combining your gateway with orchestration can make your payment system stronger and more adaptable without replacing what already works.

Takeaway

There is no longer a strict divide between gateways and orchestration. What matters now are the results: how often payments succeed, how much each one costs to process, how quickly new methods go live, and how well the system holds under pressure. The focus has shifted from definitions to measurable outcomes, such as reliability, efficiency, and compliance.

| Before: Gateway | Before: Orchestration | Today: Modern Providers | |

|---|---|---|---|

| Payment methods | Primarily card payments with limited local options | Wide range through third-party connections | Broad coverage of cards, wallets, and APMs within one setup |

| Integrations | Direct API connection with one processor | Multiple integrations managed separately | Single integration connecting many acquirers and payment methods |

| Routing | Fixed route for each transaction | Smart routing and cascading between gateways | Dynamic routing built into the core platform |

| Anti-fraud | Core data security and encryption | External fraud detection tools | Integrated, multi-layered fraud prevention across all routes |

| Compliance | PCI DSS handled per provider | Managed separately across systems | Centralised compliance and certification under one provider |

| Reporting | Transaction summaries and logs | Aggregated reports from multiple gateways | Unified dashboards with real-time analytics |

| Scaling | Tied to one provider’s capacity | Flexible, but needing technical support | Elastic capacity with automated load balancing |

| Cost structure | Transaction-based fees per gateway | Combined costs from multiple providers | Optimised cost per successful payment through smart routing |

| Risks and retries | Limited failover support | Conditional retry mechanisms | Continuous operation with automated rerouting and failover |

Both approaches had their strengths. Gateways made payments simple and dependable, and orchestration gave companies more reach and control. The new blended model combines the best parts of both and turns them into a single, more capable system.

Thank you for reaching us. Your request has been sent successfully. We will get back to you as soon as possible.

Message was not sent