Global Payouts: How to Pay Third Parties Globally with Ease

- What Are Global Payouts and Why Do They Matter in 2025?

- How Global Payout Platforms Work

- Main Benefits of Using a Global Payout Solution

- Key Use Cases for Global Mass Payouts

- How to Choose the Right Global Payout Platform

- Top Global Payout Methods in 2025

- How to Integrate a Global Payout API Into Your Business

- Challenges in Managing Global Payouts (and How to Solve Them)

- Why Global Payouts Are the Future of Scalable Businesses

- FAQ

Sending payouts can be frustrating, especially when money has to cross borders. Companies juggle different currencies, handle foreign exchange fees, and sometimes build custom tools just to collect bank details. Recipients end up waiting much longer than expected.

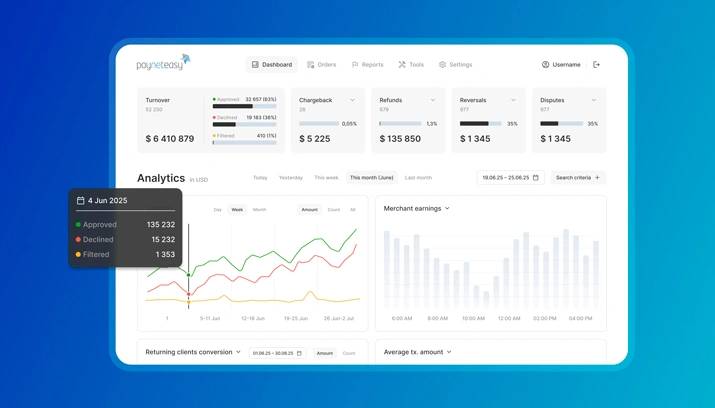

Global payout providers like Payneteasy are changing that. They let businesses send money to contractors, vendors, policyholders, or customers securely and reliably, without the usual back-and-forth. When payments are simpler, businesses don’t have to worry so much about mistakes1 and can actually focus on the work that keeps them moving forward.

Here’s what the whole process looks like.

What Are Global Payouts and Why Do They Matter in 2025?

Global payouts are the systems businesses use to send money to people or partners across borders. Instead of relying on slow bank transfers or manual workarounds, these platforms let a company in London pay a contractor in Nairobi, a driver in Warsaw, or a supplier in Manila with much less friction.

For UK firms, it means they can hire abroad, run international marketplaces, or expand into new regions without getting stuck in the old maze of currency conversions and transfer delays.

Marketplaces rely on clear, reliable payouts to keep sellers on board. Remote teams expect their pay to land directly in their local accounts rather than going through slow international systems. Gig platforms get judged by how quickly freelancers get their funds. Even established exporters now feel the push to settle bills in local currencies if they want to stay competitive.

How Global Payout Platforms Work

Most global payout platforms offer an API that a company can plug into its own system. For example, a marketplace can set up automatic payouts to thousands of sellers at once instead of uploading spreadsheets or logging into a bank portal every time.

The platform decides how to send the funds. A transfer from London to Berlin may go through SEPA in euros on the same day, and a payment to India may go through SWIFT or a local partner bank. These routes, called payout corridors, are there to match each payment with the fastest and most cost-effective option.

Before a recipient sees the money, the platform requires bank account checks or ID verification to meet rules on fraud prevention and compliance with KYC or AML laws2. Some services let recipients create a profile once and use it again with different payers, which saves time for both sides.

The platform also checks sanctions lists, flags unusual transfers, and applies foreign exchange rates where needed.

Main Benefits of Using a Global Payout Solution

Here are the key benefits of handling international payments through one simple system:

Faster Cross-Border Payments

Money no longer crawls through the banking system for days. Funds can reach an account in India in under a minute or arrive in Brazil the same day by tapping into local rails instead of long routes.

Lower Costs with Transparent FX Fees

Traditional banks layer charges at every step, and the final amount can be less than expected once it reaches the recipient. Modern payout systems show the exchange rate up front and remove most of the intermediary fees.

Automated Compliance & KYC

International transfers must respect rules related to fraud prevention and money laundering, but doing this in-house is heavy work. Payout platforms take on the checks in the background: verifying recipients, storing documents, and reporting to regulators.

Real-Time API Integrations

Instead of uploading spreadsheets or chasing manual approvals, businesses can link a payout API directly into their finance tools.

For example, a business can set global marketplace payouts to run once an order clears, or a staffing platform can pay workers as soon as hours are approved. The status of every transfer is available immediately through the same link.

Improved Recipient Experience

For the person on the other side, the way the money arrives matters. Global payout platforms provide this flexibility, and when money arrives quickly and in the right format, trust in the business grows.

Key Use Cases for Global Mass Payouts

Some payment challenges only become obvious when money has to reach many people at once. That’s where mass payouts prove their worth.

Marketplaces

Think about platforms like Etsy or Upwork. Every week, they need to get money to thousands of sellers and freelancers around the world. Mass payouts make sure funds reach accounts quickly, so sellers can focus on their work instead of waiting for payments to clear.

Gig Platforms

Services like Uber and Fiverr rely on paying workers in multiple countries. Timely, predictable payments help drivers and freelancers trust the platform and keep doing their jobs.

Affiliate Networks

Amazon Associates, Rakuten, or Impact need to pay commissions to affiliates around the world. Mass payouts let them settle dozens or even hundreds of accounts at once.

Freelancers and Content Creators

Patreon, Substack, and Canva pay creators like writers, designers, and video producers directly. Creators can choose to receive funds to a bank account, card, or digital wallet.

SaaS Companies with Global Contractors

SaaS companies, such as Shopify and Slack, collaborate with developers and consultants across multiple countries. Similar to other industries, they rely on mass payouts to handle payments efficiently.

How to Choose the Right Global Payout Platform

The platform you choose will determine how secure your transactions are, how transparent the costs look, and how well the system supports your business as it grows.

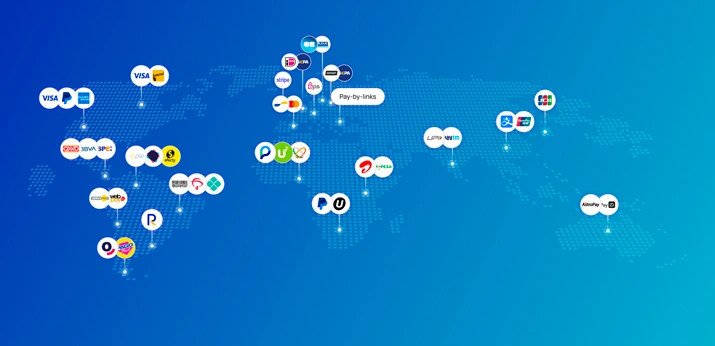

Geographic and Currency Coverage

Check that the platform supports the countries and regions where your recipients are located. If you work with contractors, sellers, or affiliates across multiple currencies, make sure the system can send and receive funds in the ones they use. You may also want to consider countries and currencies you might need in the future.

Speed and Reliability

Look at how quickly payments reach recipients and how often the system experiences downtime. Some global payout solutions offer fallback routes or alternative payment rails to keep transfers moving even when one network slows or fails.

Fees and Transparency

Costs should be predictable. Confirm how the platform charges for transactions, withdrawals, and foreign exchange. Hidden fees or fluctuating FX rates can quietly erode payouts and frustrate recipients.

API and Integration Options

Review the developer tools and integration options. Strong API documentation, SDKs, and plug-and-play connections make it easier to automate payouts and link the platform to your existing finance or ERP systems.

Support and Dispute Resolution

Check how the platform handles onboarding, answers questions, and resolves payment issues. When problems arise, you want a system that responds quickly and keeps payouts on track.

Top Global Payout Methods in 2025

At this point, it’s worth looking at the payout methods businesses rely on today, as well as the newer ones gaining ground.

SWIFT Transfers

The SWIFT network is the traditional method for cross-border bank transfers.

- Global reach, connects thousands of banks worldwide

- Trusted and secure system

- Can take several days to complete

- Expensive due to bank fees and intermediary costs

eWallets and Mobile Money

Digital wallets and mobile money services offer fast alternatives to traditional methods, especially in regions with limited banking infrastructure.

- Fast, often instant transfers

- Accessible in regions with limited traditional banking

- Convenient for recipients without a bank account

- Limited to certain countries or platforms

- Fees vary depending on the provider and currency

Examples and popularity:

- Payoneer: widely used by freelancers and marketplaces globally

- PayPal: common for small international transfers, especially in the US and Europe

- Alipay: popular in China for payments to consumers and businesses

- M-Pesa: common in Kenya and parts of Africa for mobile-based transfers

- GCash: widely used in the Philippines for mobile payouts and peer-to-peer transfers

Prepaid Cards

Virtual and physical prepaid cards provide recipients with instant access to funds without a bank account.

- Instant access to funds without a bank account

- Flexible for spending in multiple currencies

- Useful in regions where bank transfers are slow

- May carry activation or maintenance fees

- Limited in where they can be used or withdrawn

How to Integrate a Global Payout API Into Your Business

A payout API takes effort to set up, but the steps are clear. Once security, payouts, and tracking are in place, it works as part of your system.

API Authentication and Access

Most platforms provide API keys, OAuth tokens, or certificates to confirm your system’s identity. Assign roles carefully so only authorised team members can send payments or access sensitive data.

Currency Handling and Conversion

Some platforms let you lock in rates for scheduled payouts or batches, which keeps the amount your recipients receive consistent and helps you get the maximum value from each transfer. Plan ahead for the currencies you use most to avoid unexpected losses.

Compliance and KYC Integration

Take advantage of the tools your provider offers to handle KYC and AML requirements. Gather the necessary information from recipients, verify their identities, and keep records in secure storage. You can do this through an API or dashboard to avoid mistakes.

Challenges in Managing Global Payouts (and How to Solve Them)

Modern global payout systems solve most cross-border payment problems, but a few tricky issues still pop up that businesses need to watch out for.

FX Volatility

Currency values can change between the moment you send funds and when recipients receive them. You can manage this by locking exchange rates for scheduled payouts or using forward contracts to protect payments from sudden swings.

Regulatory Compliance

Each country has its own rules for cross-border payments, which can affect how and where you send money. Platforms that track local laws and alert you to restricted transactions can prevent mistakes and failed transfers.

Country-Specific Restrictions

Some regions limit which payout methods you can use or require additional reporting. Certain transfers to high-risk jurisdictions3 may be blocked or require extra approvals. To avoid this, check supported countries and payment options before sending funds.

Fraud Prevention and KYC

Payments can be intercepted or sent to the wrong person if identities aren’t checked. You can prevent this by confirming recipient information and watching for unusual activity before sending funds.

Why Global Payouts Are the Future of Scalable Businesses

Not long ago, sending money across borders meant delays, high fees, and little clarity on the financial status of payments. That picture is changing quickly. Back in 2020, UK banks like Lloyds started using SWIFT GPI Instant, connected with the UK’s Faster Payments service. In one test, payments from overseas cleared and settled in about a minute, with some arriving in just 30-40 seconds.

The next stage looks even more promising. Central banks are testing ways to cut cross-border costs by as much as 80% in some cases, and regulators in Europe are preparing to require real-time payments across most providers by the end of 2025. At the same time, smarter use of local payment systems will help international transfers feel less complicated and almost as easy as sending money at home.

The future of cross-border payouts could soon look a lot like domestic transfers.

Sources

[1] - EY, The rise of PayTech - seven forces shaping the future of payments, November 2022

[2] - GOV.UK, Your responsibilities under money laundering supervision, May 2025

[3] - The FATF, High-Risk Jurisdictions subject to a Call for Action, June 2025

Frequently Asked Questions

What is a global payout?

It’s the process of sending money to people or businesses in other countries. Instead of handling transfers one by one, you can manage payments across borders in a structured way.

How do global mass payouts work?

They allow you to send many payments at once, even if the recipients are in different countries and use different currencies. Funds move through bank networks or local partners. Each person gets paid in the way that works for them.

What’s the difference between SWIFT and local payouts?

SWIFT transfers go through an international bank network, which can be slower and more expensive. Local payouts use in-country rails and tend to reach recipients faster and with fewer fees.

Can I integrate a global payout API into my platform?

Yes, most providers offer APIs that let you automate payouts from your own system. It takes some setup, but once connected, you can send funds without logging into a separate dashboard.

What are the fees involved in global payouts?

Costs vary by provider, country, and payout method. Some charge a flat fee per transfer, while others take a cut (between 1% and 3% of the amount). On top of that, many providers add foreign exchange fees, which range from 0.5% to 2%.

Which provider is best for UK businesses in 2025?

Don't be fooled by a fast transaction. If the back-end infrastructure is shaky, speed means nothing. Real confidence in payments comes from knowing your security is locked down at every step. That means strict adherence to standards like KYC, AML, and PCI DSS is non-negotiable.

At Payneteasy, we understand trust isn't a feature you switch on. It's earned through openness, stability, and respecting the rules. We build dependable systems designed to last, giving your business the platform it needs to expand without ever losing control.

Thank you for reaching us. Your request has been sent successfully. We will get back to you as soon as possible.

Message was not sent