The Complete Guide to the Pan-African Payment & Settlement System (PAPSS)

The African continental market boasts a collective GDP of approximately $3.4 trillion and a population of over 1.3 billion people. Yet, it also features only 18% of intra-regional trade transactions, which is the lowest index in the global arena, presenting a stark contrast to Europe’s 70% and Asia’s 59%.

Fortunately, one of the region’s latest initiatives, the Pan-African Payment & Settlement System (PAPSS), is expected to be a game-changer in cross-border trade across the continent. Keep reading to find out what exactly this solution is all about, how it works, and how its implementation is forecasted to transform payments in Africa.

What Is the PAPSS Project All About?

The PAPSS is a centralized payment and settlement system for intra-African trade of goods and services that was launched in January 2022. It was ideated by the African Export-Import Bank alongside the African Continental Free Trade Area (AfCFTA) Secretariat and uses a digital, cloud-based platform developed by StoneX.

The fundamental offering within the PAPSS framework is the PAPSS Instant Payment (PIP™) system, which facilitates instant wholesale and retail payments while also ensuring seamless connectivity among banks and PSPs.

Since the African continent has 42 individual currencies, the introduction of PAPSS was a critical strategic move for the region. Before the launch of this system, local businesses and financial institutions had to rely on banks based outside the country to settle transactions between two African currencies in a third currency like USD or EUR.

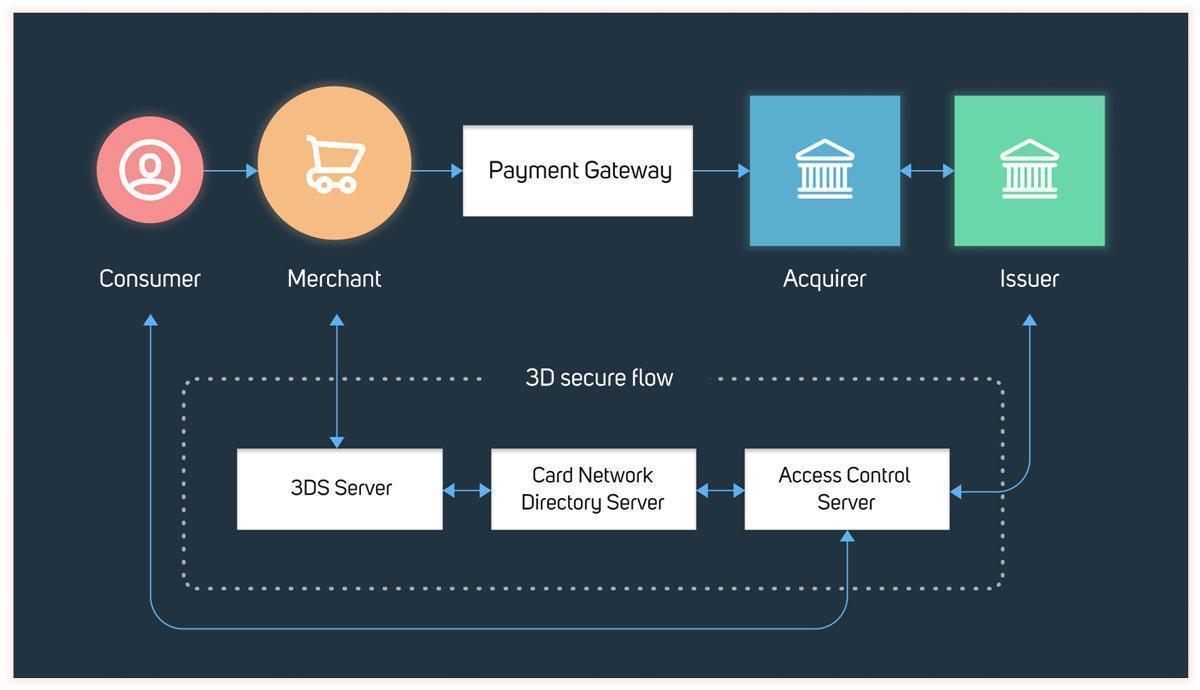

How Does This System Work?

The process of making payments through PAPSS is straightforward and consists of the following steps:

- A company forwards a payment instruction to its local bank or PSP.

- Then, the bank sends this instruction to its Central Bank, which, in turn, transmits it to PAPSS.

- The system validates the instruction and forwards it to the beneficiary’s Central Bank and local bank.

- Finally, the local bank releases the transferred funds to the beneficiary in the local currency.

In simple terms, PAPSS links the real-time gross settlement (RTGS) systems of individual African Central Banks. The system reconciles the balances of all transactions among individual African currencies daily, netting them out before midnight. Any remaining differences are resolved by the Central Banks. The following day, the payments and settlement process restarts from net zero.

Fundamental Elements of PAPSS’s Implementation

The implementation of PAPSS is revolving around three key directions, namely:

- Onboarding African central banks to the PAPSS network. By the end of 2024, all 41 African central banks are expected to be linked to PAPSS. Currently, the network has already attracted 11 central banks, with Kenya becoming the most recent addition to the list in September 2023.

- Central banks establishing connections with leading local banks. As of November 2023, PAPSS has linked up with 28 of the most prominent commercial banks on the continent, including Ecobank, Zenith Bank, and Stanbic. By the end of 2025, all commercial banks in Africa are expected to sign an agreement with PAPSS.

- Providing locally licensed fintechs access to the system. This is meant to enable fintech companies to better process intra-African trade-related transactions, including those conducted via mobile platforms.

- Establishing interoperability between PAPSS and BUNA. On April 26, 2022, PAPSS formalized a Memorandum of Understanding (MoU) with BUNA, the cross-border and multi-currency payment system owned by the Arab Monetary Fund (AMF). This partnership will provide mutual benefits to both networks and unlock expansion perspectives.

All in all, the combination of these efforts is aimed at creating a comprehensive, modern, and interconnected financial ecosystem in Africa.

Will PAPSS Fulfill Its Mission Despite the Challenges It Encounters?

Despite its promising adoption pace and ambitious goals, the PAPSS initiative still experiences hurdles throughout its implementation process, including:

- Complex cross-border partnership dynamics

- Varying levels of technological infrastructure across the continent

- System outages and cybersecurity risks

However, even with these challenges on the plate, industry experts remain positive regarding the system’s transformative potential.

What’s more, John Bosco Sebabi, PAPSS deputy CEO, emphasized the importance of this project by saying: “Trade goes well where payments can be made easily, and this is why we can only see trade pick up if we see improvement in efficient payments”.

Overall, the alignment of PAPSS’s goals with broader economic objectives positions it as an irreplaceable player in shaping the future economic landscape of the African continent. However, continued efforts to address the pressing challenges and adapt to the evolving circumstances will be crucial for the network to achieve its goals and ensure scalability.

Thank you for reaching us. Your request has been sent successfully. We will get back to you as soon as possible.

Message was not sent