Payment Orchestration: What It Is, How It Works, and Why It Matters for Modern Businesses

- Introduction to Payment Orchestration

- How Does Payment Orchestration Work?

- Payment Orchestration vs Traditional Payment Systems

- Core Components of a Payment Orchestration Platform

- Benefits of Payment Orchestration for Businesses

- Real-World Use Across Teams

- How to Choose the Right Payment Orchestration Provider

- The Future of Payment Orchestration

- FAQ

Payment orchestration unites payment gateways, processors, acquirers, and other financial service providers on a single platform. In turn, businesses can manage transactions more efficiently, cut down on technical complexity, and operate across multiple markets. All of this happens while still meeting a wide range of customer preferences.

In 2022, the global payment orchestration market was worth $1.13 billion, and it is expected to hit $6.52 billion by 2030. Such rapid growth means payment orchestration will play a bigger role in how businesses handle payments and operate online.

In this article, we explore payment orchestration, meaning we provide a definition, investigate its key features, and learn why it matters for modern businesses.

Introduction to Payment Orchestration

Many businesses aim to consolidate their payment vendors, but in practice, fragmentation is often necessary. Businesses need different gateways, acquirers, and alternative payment methods to meet the needs of customers in various regions. In fact, S&P Global reports that most companies with over 1,000 employees prefer to use multiple providers to stay flexible, access multiple geographies, and optimise costs. However, managing multiple services also increases complexity, so companies rely on an orchestration system to coordinate and optimise these connections.

Some large merchants build custom in-house platforms to handle orchestration, but this approach requires significant engineering and operational resources. Payment orchestration platforms solve this problem by providing prebuilt integrations with dozens or even hundreds of providers through a single cloud-based interface.

Industries with high transaction volumes or global operations, such as e-commerce, igaming, forex, casino, and large operators, benefit most because orchestration systems simplify international expansion and enhance the overall payment experience.

How Does Payment Orchestration Work?

A payment orchestration platform manages the full journey of a transaction, from the moment a customer initiates a payment to its final reconciliation.

1. Transaction Initiation

When a customer makes a payment, the platform chooses the provider that offers the best chance of success. It looks at cost, approval likelihood, customer preferences, currency, and regional rules to decide the route.

2. Routing and Processing

The platform handles communication between the customer and the chosen provider. If a transaction fails, it can try another route. Multiple gateways and PSPs work together through APIs to authorise and complete the payment.

3. Reconciliation and Data Management

Once a payment is processed, the platform checks that records match across all providers and accounts. It consolidates statements and tracks each transaction so finance teams can see exactly what happened.

4. Analytics and Insights

The platform collects information about every transaction and shows patterns, reasons for payments being declined, and performance trends.

5. Customisation and Control

Rules and workflows can be set to match a business’s priorities. This allows it to decide how payments are processed, monitored, and managed, without building separate connections for each provider.

Payment Orchestration vs Traditional Payment Systems

Traditional payment systems usually rely on a single payment service provider or gateway. A PSP handles transactions and may include fraud-prevention tools. A payment gateway, on the other hand, moves transaction data between the customer’s bank, the acquiring institution, and the payment portal. Expanding into new regions or supporting multiple payment methods often requires working with several PSPs and gateways, which makes operations harder to manage.

Payment orchestration platforms go beyond processing individual payments.

| Feature | Traditional payment systems | Payment orchestration platforms |

|---|---|---|

| Setup | One PSP or gateway at a time; simple but limited | Multiple providers; more setup, but centralised |

| Flexibility | Limited to each provider’s coverage | Many providers and methods need careful configuration |

| Control | Managed separately for each provider | Central control over routing and workflows |

| Optimisation | Some built-in tools | Can optimise routing and approvals |

| Reporting | Provider-specific reports, manual consolidation | Consolidated insights |

| Fraud & security | Depends on provider tools | Integrated tools improve coverage; needs monitoring |

Core Components of a Payment Orchestration Platform

An orchestration system blends the technical backbone with practical tools that support reliable processing, adaptability, and clear oversight of payment operations.

Smart Routing & Optimisation

Smart routing ensures each payment takes the path most likely to be approved. It factors in location, currency, and how each processor has performed in the past. If a transaction is declined, fallback logic immediately sends it through another route to reduce the risk of losing a sale.

For example, some platforms use dynamic processor selection to raise approval rates and keep processing costs in check.

Payment Method Aggregation

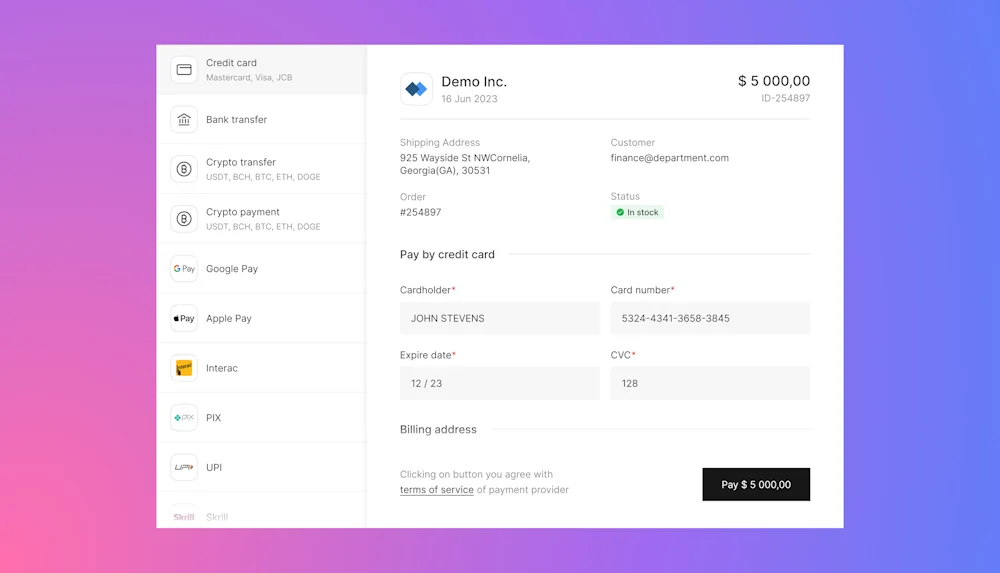

Instead of building separate connections for every payment option, a payment orchestration platform links you to many at once: cards, bank transfers, digital wallets, alternative payments, and cryptocurrencies. This way, it’s much easier to adapt to customer preferences in different regions.

Customisation of Payment Forms & Method Display

A payment orchestration platform connects multiple payment methods and also gives businesses control over how they are presented to customers. Payment forms can be customised to display preferred methods in one place, while specific options can be enabled or disabled based on region, customer type, or popularity. For example, a merchant may rank certain payment methods higher for customers in Europe while prioritising mobile wallets in Asia.

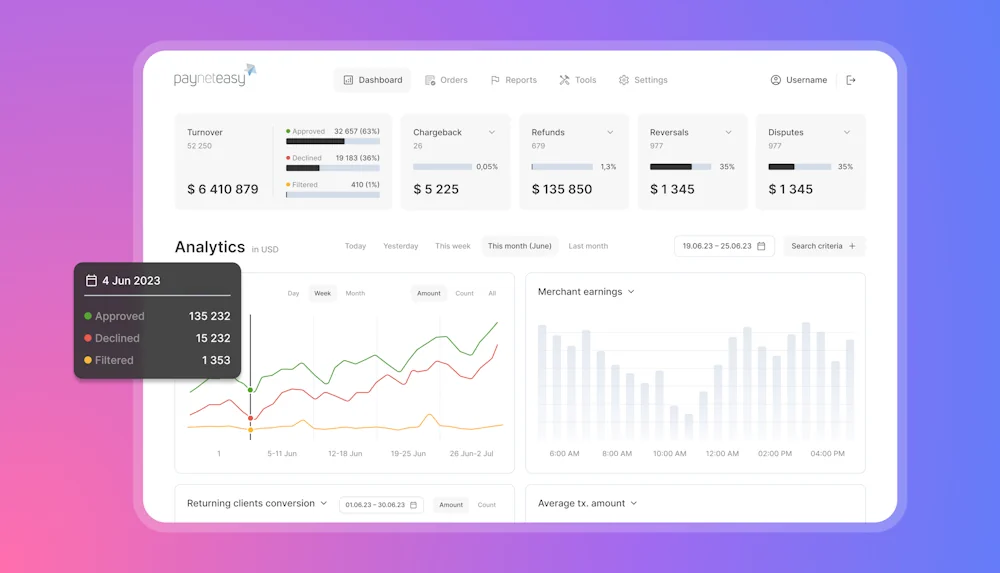

Analytics & Reporting

All payment data is brought together in one place. For example, you can combine profit reporting, reconciliation checks, and processor-level analytics. This gives businesses a clearer overview of how their payments are performing and makes it easier to see how providers stack up.

Also, real-time dashboards and clear reporting help teams understand what’s working and where adjustments are needed.

Third-Party Integrations

An orchestration platform connects with the systems a business already uses, such as a CRM, ERP, BI tool, fraud prevention solution, or KYC services. Teams can improve security and make operational changes without having to overhaul their setup. Such platforms can embed adaptive anti-fraud filters and connect with external services that reduce chargebacks and keep payment channels secure.

Benefits of Payment Orchestration for Businesses

A payment orchestration platform can reshape how a business manages its transactions. Let’s look at how this approach can create real, measurable advantages for companies of all sizes.

Higher Acceptance Rates

Using multiple payment providers and automatic retry mechanisms increases the number of successful transactions. Well-built platforms demonstrate how this approach can noticeably improve approval rates.

Cost Optimisation

The platform can select the most cost-effective route for each payment, which lowers processing fees. Access to multiple providers also gives businesses better negotiation leverage, and centralising operations reduces administrative overhead.

Improved User Experience

Providing local and familiar payment options, combined with fast processing, makes checkout simpler for customers. This helps reduce abandoned carts and improves conversion rates.

Enhanced Fraud Management

Built-in or integrated fraud tools, such as 3-D Secure, tokenisation, and rules engines, protect payments across regions. These systems adjust to the risks in each market, reduce chargebacks, and allow genuine transactions to go through.

Global Scalability

Orchestration platforms simplify expansion into new countries by integrating local acquirers and payment methods. Businesses can start serving customers in different regions quickly, with the payment options they expect.

Who Needs a Payment Orchestration Solution?

These are some types of businesses that benefit most from a payment orchestration solution:

- Large e-commerce sites – Global e-commerce retailers handle dozens of currencies and regional payment methods. For example, a retailer selling in both Europe and Asia may need separate gateways for credit cards, local wallets, and alternative methods to reach customers in each market.

- SaaS platforms & subscription services – Subscription-based software companies often deal with recurring payments in multiple countries. A SaaS provider with global monthly plans may see frequent declines from expired cards or bank-specific rules, which means they need to manage multiple payment providers.

- Multi-region businesses – Travel agencies, hotel chains, and online marketplaces that operate internationally need to accept local payment methods and follow regional rules. For example, a hotel booking platform handles payments in different currencies while meeting PCI standards and local tax requirements.

- Marketplaces – Online marketplaces link buyers and sellers and tend to require split payments or custom payout schedules. For example, a global craft marketplace processes payments for hundreds of vendors, handles refunds, and supports both local and international payment methods at the same time.

- Other high-volume or complex businesses – High-volume sectors like gaming, digital media, or ticketing, process thousands of transactions every day. For example, a concert ticketing platform may use multiple PSPs to manage peak traffic and quick settlements during busy events. In betting, payments also need careful routing to follow local regulations and keep operations compliant.

Real-World Use Across Teams

Payment orchestration platforms help businesses manage complex payment operations, and their impact can be seen across different roles:

Payment Managers

All information from various PSPs is consolidated into a single management interface. The platform provides unified reports and statements that combine traffic from all providers. Analytical tools track earnings in real time, and the system identifies the reasons for payments being declined by each processor.

Risk Managers

The platform helps safeguard the business against fraud and prevent disputes. Built-in anti-fraud filters with auto-learning capabilities can enforce transaction limits, and integrations with services like Ethoca help prevent chargebacks and protect payment channels.

CFOs

Finance teams can check that figures match agreed parameters. The platform verifies that PSP and wallet statements are accurate and confirms that the correct amounts have been paid to the bank.

How to Choose the Right Payment Orchestration Provider

Do you need a simple integration or more flexibility? How quickly are your transactions growing, and which payment methods matter most to your customers? Can your team manage complex requirements, and how important is visibility into costs and declines?

Thinking through these questions will point you toward the right solution for your operations.

Key Features to Consider

When looking at payment orchestration platforms, it helps to focus on the features that actually make your day-to-day operations more manageable:

- Ease of integration – The platform should connect quickly to existing systems, including CRMs, ERPs, and payment providers, without requiring extensive development work.

- Uptime and reliability – High availability ensures transactions are processed reliably and reduces the risk of downtime or lost revenue.

- Dashboard and reporting – A centralised dashboard should provide real-time insights into transaction flows, earnings, and decline reasons.

- Smart routing – The system should intelligently select the best payment route based on cost, success rates, and customer preferences to optimise approvals.

- Scalability – The platform must handle increasing transaction volumes and easily support expansion into new markets or regions.

- Support and documentation – Access to responsive support and clear documentation helps resolve issues quickly and makes onboarding easier.

- Sandbox environment – A sandbox or test environment lets businesses try integrations and workflows before going live, which helps prevent errors and lowers risk.

Compliance and Security

A payment orchestration platform must meet strict compliance standards to protect both businesses and their customers. Most top platforms hold PCI DSS Level 1 certification, which keeps card data secure. Token vaults and secure APIs provide extra protection and reduce the risk of fraud or data breaches.

In addition to payment security, platforms should support compliance with data privacy regulations like GDPR. This helps businesses manage personal data responsibly and maintain customer trust.

The Future of Payment Orchestration

Payment orchestration is moving beyond basic routing to a broader ecosystem approach. Open banking lets regulated businesses access customer bank accounts securely and enables direct payments with Face ID or fingerprint authentication. While orchestration platforms can incorporate open banking, these payments don’t depend on them.

Variable Recurring Payments (VRP) is set to transform recurring payments. Unlike traditional Card-on-File setups, VRPs give consumers control over how and when payments are made to reduce declines and unexpected charges. Merchants benefit from immediate settlement, better payment matching, and less back-end work.

Machine learning is playing a bigger role. It helps platforms predict which processors are most likely to approve transactions based on location, time, and history. Embedded finance is also expanding. Businesses can integrate payments, loyalty programmes, and commission distribution directly into their platforms, producing richer and more efficient systems. Ecosystem orchestration ties all these capabilities together to keep everything coordinated.

All things considered, the future will bring intelligent networks that make payments faster and give businesses the tools to grow worldwide while keeping customers’ experiences simple and reliable.

Frequently Asked Questions

What is a payment orchestration platform?

A payment orchestration platform connects multiple payment providers, banks, and methods through a single system. It manages the full payment process, including routing, reporting, and reconciliation.

Is payment orchestration the same as a payment gateway?

No. A payment gateway only transfers payment data securely between a merchant and a processor. A payment orchestration platform includes a gateway and adds routing, analytics, fraud prevention, and management of multiple providers.

Do I need a payment orchestration system for my e-commerce store?

Possibly. It is most useful for businesses with multiple payment providers, international customers, or a need to increase transaction success rates. Smaller stores may also benefit if they plan to expand or offer more payment options in the future.

Thank you for reaching us. Your request has been sent successfully. We will get back to you as soon as possible.

Message was not sent