Trade Acquiring – What is it and Who is it suitable for?

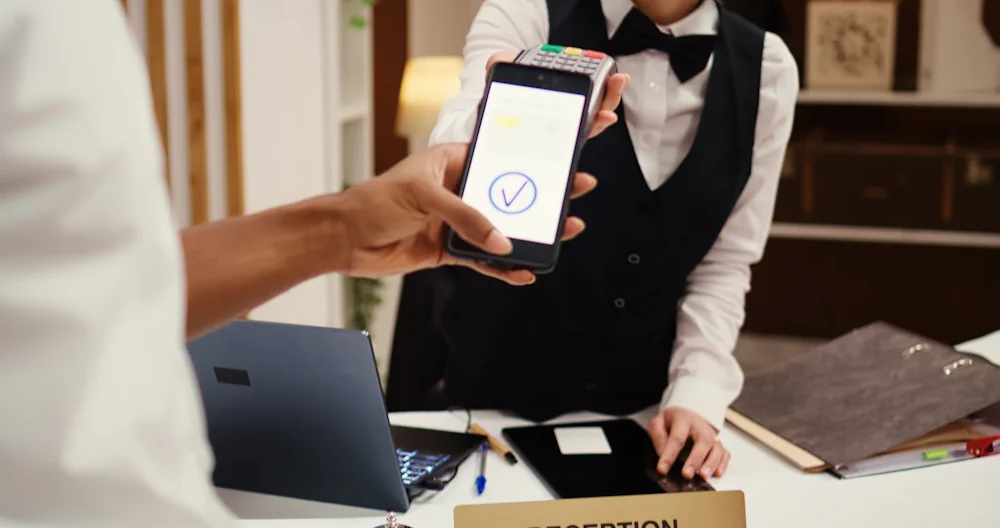

Trade (offline) acquiring is a service connected by banking institutions so that any retail point of sale, from a local store up to large supermarkets, can accept cashless payments. For this purpose, a specialized device – a POS terminal – is required to make payments using the client’s bank card.

Benefits of using Trade Acquiring in your Business

A businessman who connects to this service gets simpler, faster, and more convenient solutions for making payments.

- The main advantage of using trade acquiring is an increase in the clients’ solvency through non-cash payments.

- It reduces the level of risk of getting counterfeiting money.

- It becomes easier to manage the Payment Orchestration.

- An entrepreneur can save a lot on cash collection and commissions for crediting cash to a current account.

Difference from Mobile and Internet Acquiring

| Trade | Internet | Mobile |

|---|---|---|

| This is a service that an acquiring bank provides to a store or other commercial organization that works with customers. It allows a merchant to accept cards for payments. The bank installs POS terminals in merchant’ sales points to carry out cashless transactions. | This is one of the types of trade acquiring. Its difference is that the merchant and the customer do not interact directly; in this case, we deal with e-commerce, i.e. purchases with the card are made via the Internet. As soon as the client buys the product in an online store, the merchant is instructed to transfer money from the client’s account to the store’s account using card details. | This is one of the new technologies of accepting card payments using a mobile application and a special terminal. This type of acquiring is welcomed by couriers who deliver purchases directly to the customer’s home. The mPOS terminal reads the card data and transmits it to the courier’s smartphone, where the transaction is carried out using a special application. |

Who Benefits from Offline Acquiring and in What Way?

Today, a competitive shop must provide the option of non-cash payments. Otherwise, customers will quickly switch over to more advanced competitors. The advantages are obvious:

- More and more customers prefer cashless payments.

- Revenue is higher. It is proved that people tend to spend 10-15% more when paying non-cash.

- Cash collection is cheaper. With non-cash payment, there is no need to use cash collection services.

- Cashiers’ obligations are reduced, and the scope of work is getting less. A cashier does not have to give change and count cash. Thus, less time is spent on serving one client.

- It is guaranteed that no counterfeit money will be received.

How to pick the Right Acquirer?

The quality and effectiveness of trade acquiring depend on the qualifications and options provided by financial institution. Looking through the offers of different organizations, you need to pay attention to:

- A variety of services provided. It is good if a merchant bank does not just process transactions, but also provides clients with additional services.

- Payment equipment. Depending on the choice of particular devices, the terms of service differ.

- Tariffs. The percentage is often set individually, based on the turnover, the number of customers of a company. Check out the equipment rental rates.

- Provided technology. These are not only standard terminals, but also cash registers, pin-pads, processing software and hardware.

- The type of communication with the representative of the institution affects the speed of payment.

Read the terms and conditions before signing a contract. The main ones are the points that list your responsibilities and rights. If any requirements are violated, the bank will go to court.

Types of Terminals: Which One to Choose

They distinguish the following types of terminals:

- Stationary. They are placed in one specific place. These are large-sized models that work only when plugged in. They are connected to the network via a cable.

- Portable. Devices with built-in batteries. Portable models work using Wi-Fi.

- POS systems. This is a whole complex consisting of a terminal, a device for entering information about a product or service being sold, a fiscal manager, a barcode scanner.

- Pinpad is a supplement to the main device. It is an external keyboard for entering a pin-code and presenting a card. If there is such a device, it is possible not to use the terminal for making a payment.

Buy VS Rent?

Under the terms of the agreement with the acquiring bank, the client has the right to buy equipment for permanent use or rent it. Both methods can be both beneficial and disadvantageous. It all depends on the operating mode of the outlet, the needs of a particular business.

The prices for terminals are set depending on the additional functionality and capabilities. It is unprofitable for young entrepreneurs to pay for all equipment at once, especially if they plan to purchase several models at once.

Some banks offer to rent for free. This is a good option for a beginner. But under such conditions, as a rule, used equipment is provided. With free rentals, you often have to pay more commission. Sometimes restrictions on monthly turnovers are imposed for such clients.

How to Order?

- Look through the tariff plans offered by different banks.

- Apply for the service. Clients can do it by filling in the online form on the website, calling the hotline, or visiting the bank.

- When the application is approved, the client will need to sign a contract.

- Collect all the required documents (the list is similar for all banks).

- When the contract is concluded, the acquirer’s employees visit a store and install the equipment, explain how to use it, test and configure the whole system.

Before ordering the service, you need to take into account that all organizations set fees for merchant acquiring services. It is determined for each amount debited from the client's card when making a payment.

How to Conclude the Contract?

To do this, you will need the following documents:

- the client’s passport, company registration certificate;

- constituent papers (provided by LLC);

- title documentation (for the store), bank account details;

- licenses;

- signatures.

If you have an open current account in this bank, you do not need to collect a package of documents. It is enough to come with a passport.

Upon connection to the service, the contract is concluded between the parties. There, detailed information about the entrepreneur, the bank, the rules of cooperation, and the established tariffs are prescribed.

It takes some time for employees to check all the documents. The installation and configuration of the equipment take a couple of days. It usually takes 1-2 weeks from submitting an application to connecting the terminals.

Thank you for reaching us. Your request has been sent successfully. We will get back to you as soon as possible.

Message was not sent